Direct export factoring insurance provides protection for a range of interests of commercial banks and the Development Bank of the Republic of Belaruswhen financing exporters through the assignment of receivables.

Voluntary international factoring insurance provides the financing bank with protection against the risk of a foreign debtor’s non-payment of its financial obligations under an export contract, the receivables of which have been assigned by the exporter under a factoring agreement, due to the occurrence of events constituting political and/or commercial risk.

Advantages:

- Increased turnover of the exporter’s accounts receivable.

- Ability to provide financing against the assignment of receivables for exporter projects when the credit risk is too high for the bank.

- Reduced bank costs due to the avoidance of the need for expensive banking instruments and mechanisms: letters of credit, cooperation with foreign banks and factoring companies (import factors).

- Elimination of the bank’s need to pursue collection of problem accounts receivable abroad.The procedure of interaction:

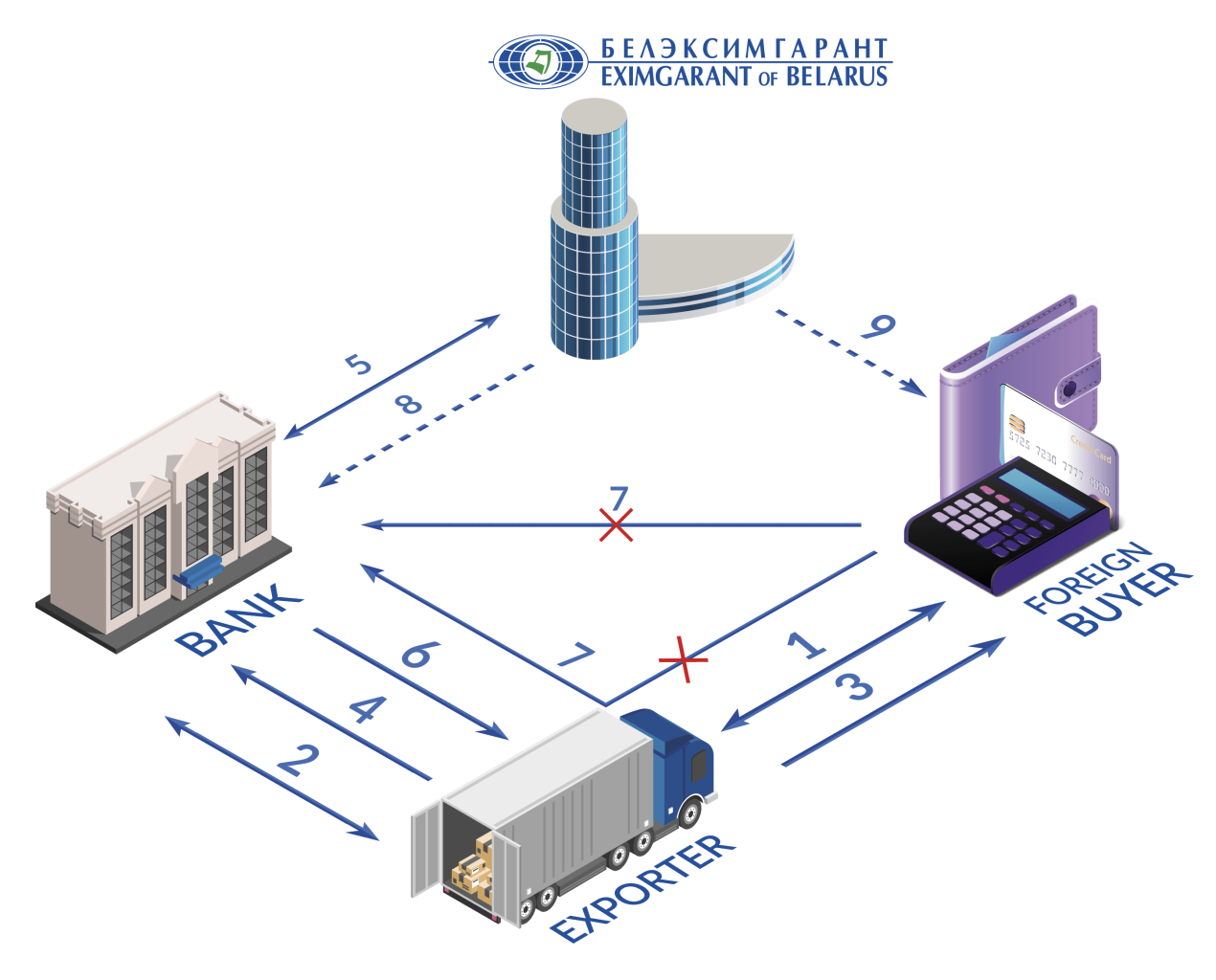

The procedure for collaboration:

1. Conclusion of an export contract;

2. Conclusion a factoring agreement;

3. Shipment of goods in accordance with the terms of the export contract;

4. Assignment of receivables;

5. Conclusion of an insurance contract;

6. Financing;

7. Non-payment under the terms of the export contract

8. Payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

9. Submitting a claim against the foreign buyer

The list of documents required for the conclusion of an insurance contract:

· Application for insurance contract conclusion;· Factoring agreement and export contract;

· Insured’s title documents

· Foreign buyer’s title and financial documents

· Creditor’s title and financial documents (in recourse factoring)

Procedure for the insured to follow in the event of an оccurrence that, under the terms of the insurance policy under which the insurance contract was concluded, may be considered an insured event.

In the event of the insured event, the policyholder is obliged to submit the required documentation no later than 30 calendar days following the end of the waiting period.

1. Original insurance policy

2. Documents proving the occurrence of the insured event and the amount of the loss

3. Written explanation from the debtor and creditor regarding the reasons for non-payment

4. Documents evidencing steps taken to prevent and/or mitigate potential losses

5. Claim against the creditor for reimbursement of the loss (in cases of recourse)

For inquiries regarding this type of insurance coverage, please contact the Export Risk Insurance Department by phone/fax in Minsk at +375 (17) 371-00-65 or to any of the Eximgarant of Belarus offices.