Eximgarant of Belarus provides an insurance product aimed at economic protection of the lessor carrying out export operations — insurance against export risks of residents of the Republic of Belarus purchasing the goods from other residents of the Republic of Belarus for leasing them to non-resident organizations in the Republic of Belarus including banks.

The insurance covers losses incurred by the lessor (resident of the Republic of Belarus) in case the lessee fails to carry out his obligations to effect lease payments under the circumstances of political or commercial risk.

We are willing to cooperate with all the Belarusian leasing companies, and we offer an up-to-date, reliable and flexible insurance product which will serve as a trustworthy instrument to do business in external markets. We assist the lessor in conducting negotiations, signing contracts, evaluating the lessee’s solvency and in arranging the financing of a deal. Eximgarant of Belarus offers flexible insurance rates and convenient modes of payment of insurance premiums.

Cooperation with Eximgarant of Belarus not only allows the lessor to receive lease payments in due course and to secure timely cash receipts, but also gives him an opportunity to gather complete and reliable information on his contractor.

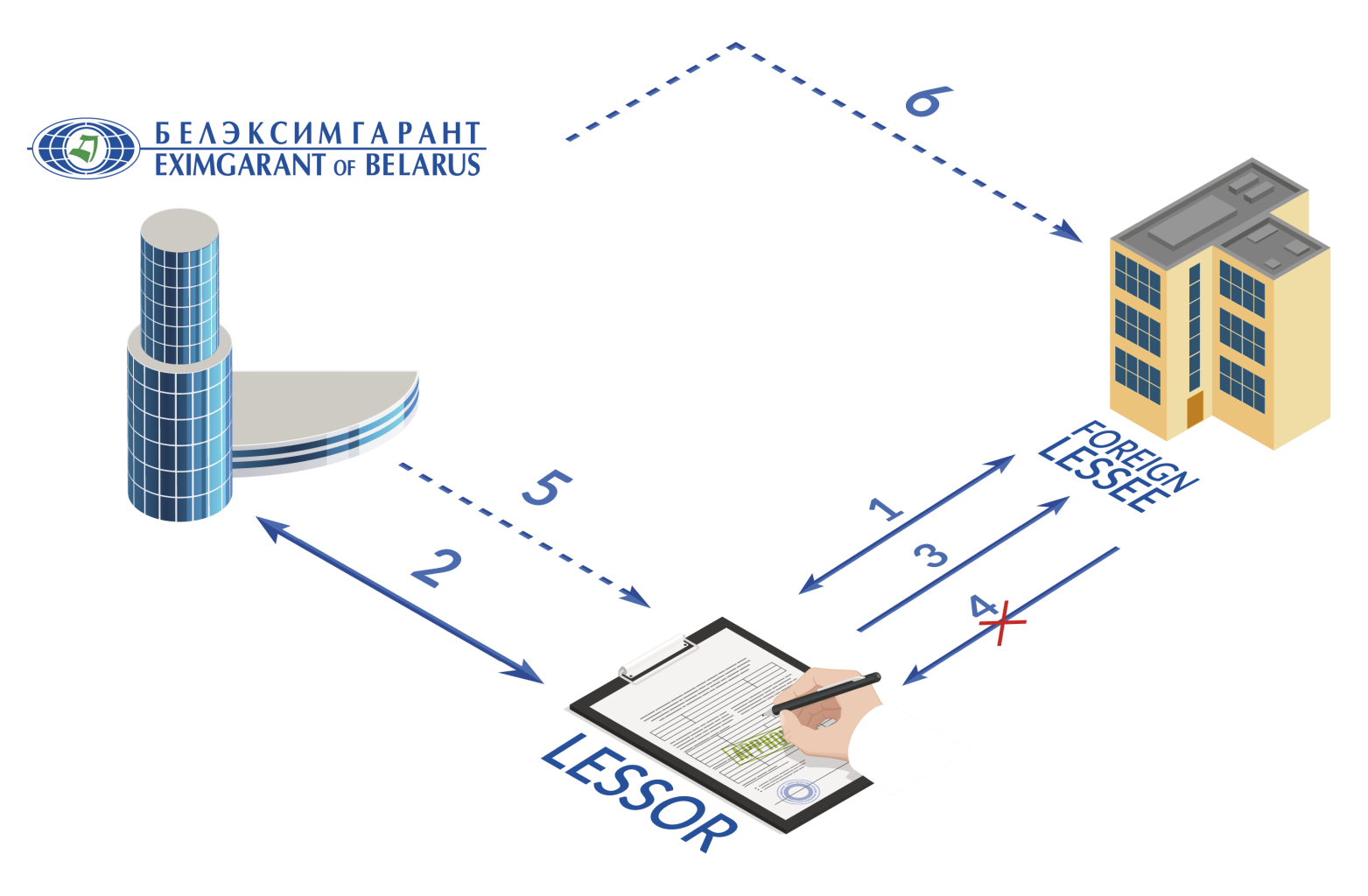

The procedure of interaction:

1. conclusion of a leasing contract;

2. conclusion of an insurance contract;

3. shipment of goods in accordance with the terms of the leasing contract

4. lease payments by the overseas lessee to the lessor;

5. payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

6. submitting a claim against the overseas lessee.

The list of documents required for the conclusion of an insurance contract:

1. application for insurance contract conclusion;

2. Insured’s title documents;

3. leasing contract;

4. foreign lessee's title and financial documents.

Procedure for the Insured to follow upon the occurrence of an accidentthat may constitute an insured loss under the terms and conditions of the insurance policy

Upon the occurrence of an insured accident, the policyholder is obligated to submit the following documents no later than 30 calendar days from the end of the waiting period:

1. Insurance claim statement;

2. leasing contract and contract concluded within the framework of ensuring the fulfillment of obligations under the leasing contract;

3. documents related to the execution of the transaction;

4. documents confirming the fact of the occurrence of an insured event and the amount of damage caused;

5. documents confirming the adoption of measures to reduce possible losses;

6. in the accident of bankruptcy of the lessee - a copy of the decision on the opening of bankruptcy proceedings in relation to the lessee;

7. other documents necessary for making a decision on the payment of insurance compensation.

For inquiries regarding this type of insurance coverage, please contact the Export Risk Insurance Department by phone/fax in Minsk at +375 (17) 371-00-65 or to any of the Eximgarant of Belarus offices.