To provide insurance protection for commercial banks when they perform under bank guarantees, Eximgarant of Belarus offers an insurance product: insurance of bank guarantees (counter-guarantees) for export contracts.The insurance covers losses incurred due to the principal’s breach of its obligations under the secured transaction, resulting from commercial and/or political risks.3

Bank guarantee insurance ensures the exporting bank does not incur losses in the accident of a call on the bank guarantee.

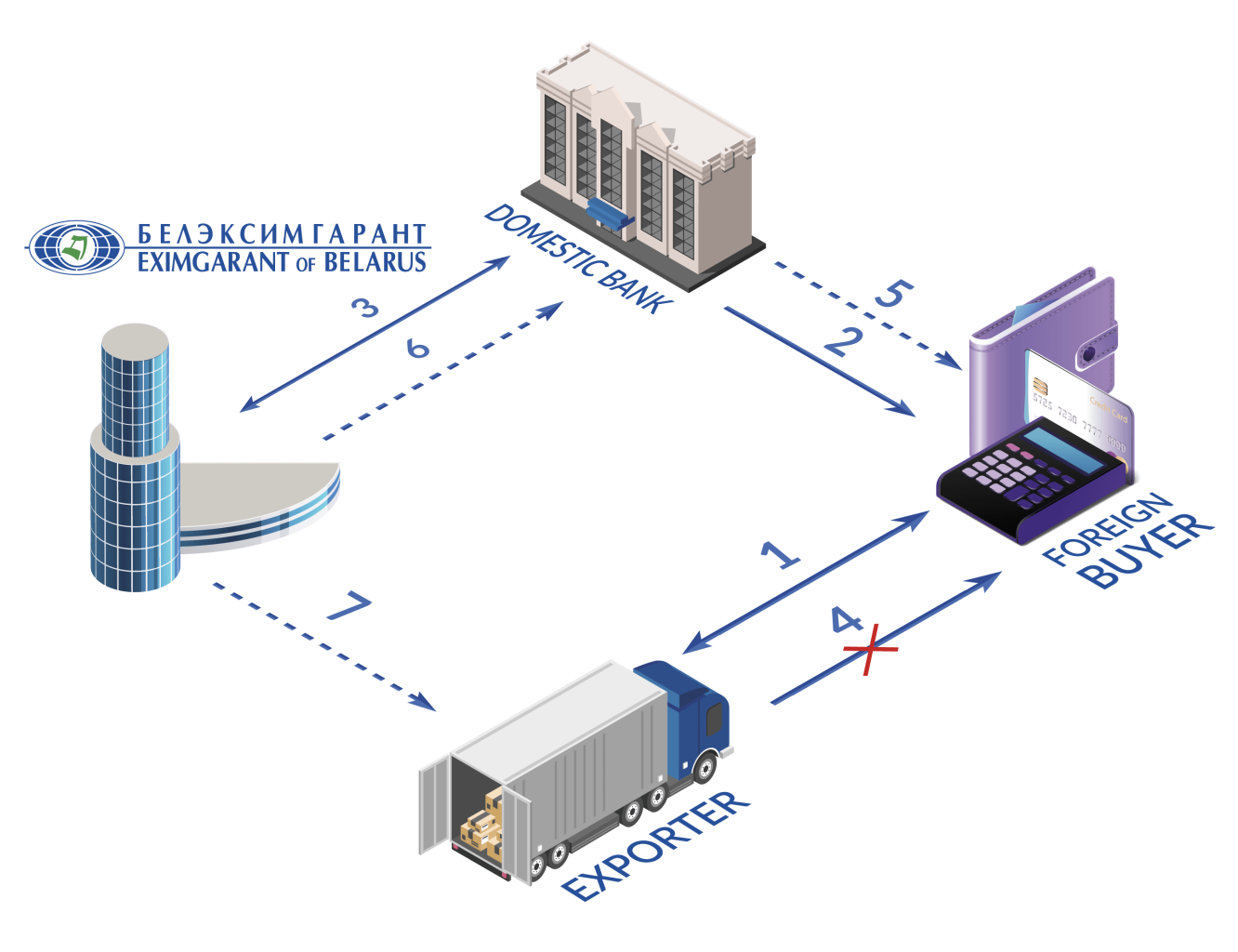

The procedure for collaboration:

1. Conclusion of the export contract;

2. Issuance of a guarantee by a domestic bank for the exporter’s obligations

3. Conclusion of the insurance contract

4. The exporter’s non-performance of its obligations under the contract

5. исполнение гарантии;

6. Payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

7. Submitting a claim against the foreign buyer

The list of documents required for the conclusion of an insurance contract:

· Application for insurance contract conclusion;

· Insured’s title documents;

· Exporter's title and financial documents;

· Documents evidencing the underlying transaction between the principal and the beneficiary, upon which the guarantee is predicated.

· Documents evidencing the principal’s collateral for its obligations to the guarantor under the issued bank guarantee (counter-guarantee).

· Agreement for the issuance of the guarantee (counter-guarantee).

· The bank guarantee (counter-guarantee) document or a preliminary version thereof.

· Any other supporting documentation required for assessing the risk profile and determining whether to execute the insurance contract.

Procedure for the Insured to follow upon the occurrence of an accidentthat may constitute an insured loss under the terms and conditions of the insurance policy

The Insured shall submit a claim to the Insurer regarding an insured accident no later than 30 calendar days from the end of the waiting period established by the insurance contract, enclosing the following documents:

· A copy of the insurance contract (insurance policy);

· Documents confirming the occurrence of the insured accident and the amount of the loss incurred;

· Documents related to the execution of the export contract or other agreements secured by the insured bank guarantee (counter-guarantee);

· Documents confirming measures taken to mitigate potential losses;

· In case of bankruptcy, a copy of the order initiating insolvency proceedings against the principal;

· Any other documents necessary for establishing the occurrence of the insured accident and the amount of the Insured’s losses.

For inquiries regarding this type of insurance coverage, please contact the Export Risk Insurance Department by phone/fax in Minsk at +375 (17) 371-00-65 or to any of the Eximgarant of Belarus offices.