The insurance covers the losses of the financing bank in the event that the borrower fails to meet their obligations under the loan agreement regarding the repayment of the principal amount within the timeframes established by the loan agreement, resulting from their bankruptcy or insolvency.Eximgarant of Belarus has developed a special insurance product within the framework of pre-export financing – insurance against the risk of non-repayment (default) and/or delay in repayment of an export loan provided to residents, including leasing organizations. The financing is provided by commercial banks and the Development Bank with the aim of replenishing working capital and fulfilling obligations under export contracts or international leasing agreements.

Financing is carried out at rates in accordance with Resolution of the Council of Ministers of the Republic of Belarus No. 495 dated September 11, 2025 "On Amendments to Resolutions of the Council of Ministers of the Republic of Belarus No. 262 dated May 5, 2021 and No. 58 dated January 24, 2023".

Upon concluding the insurance contract, the bank receives collateral under the loan agreement for the entire amount of the principal debt, which completely relieves the insurer from the lengthy debt collection process.

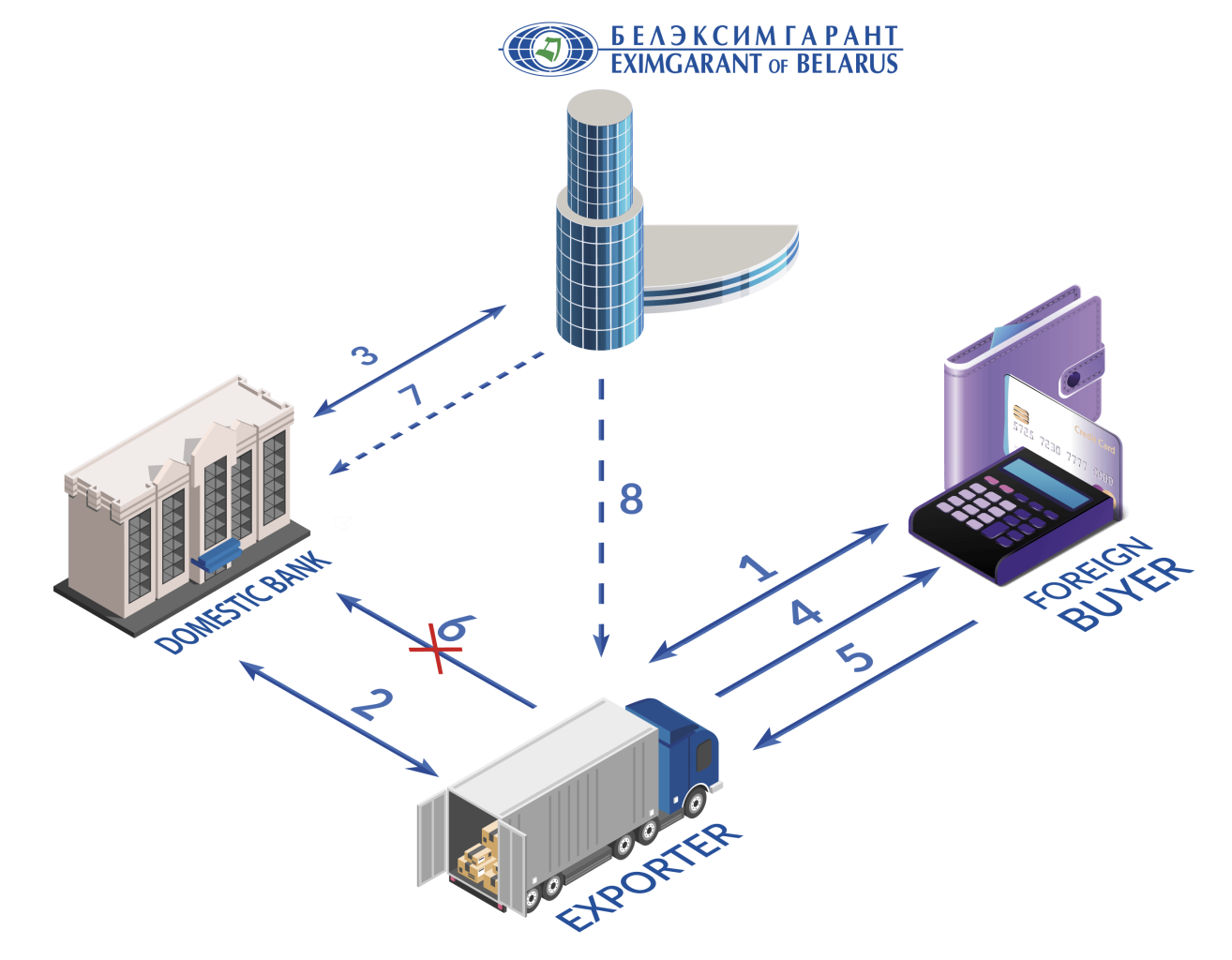

The procedure of interaction:

1. Conclusion of an export contract;

2. Conclusion а credit contract;

3. Conclusion of an insurance contract;

4. Shipment of goods in accordance with the terms of the export contract;

5. Payment by the foreign buyer for the supplied products;

6. The credit is not repaid;

7. payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

8. Submitting a claim against the borrower

The list of documents required for the conclusion of an insurance contract:

· application for insurance contract conclusion;

· Insured’s title documents

· loan agreement and agreements to secure the fulfillment of loan obligations;

· borrower's title and financial documents.

Procedure for the Insured to follow upon the occurrence of an accidentthat may constitute an insured loss under the terms and conditions of the insurance policy.

Upon the occurrence of an insured accident, the policyholder is obligated to submit the following documents no later than 30 calendar days from the end of the waiting period:

1. Original insurance policy

2. documents confirming the fact and amount of the losses;

3. documents confirming the adoption of measures to prevent and (or) reduce possible losses;

4. written explanation of the borrower about the reasons for non-repayment of the loan;

5. in case of bankruptcy of the borrower, a copy of the court decision is required

6. other documents at the request of the insurer.

For inquiries regarding this type of insurance coverage, please contact the Export Risk Insurance Department by phone/fax in Minsk at +375 (17) 371-00-65 or to any of the Eximgarant of Belarus offices.