Post-financing of a letter of credit involves the Development Bank of the Republic of Belarus granting the issuing bank of the letter of credit a specific deferral period for the reimbursement of funds transferred under the letter of credit by the Development Bank of the Republic of Belarus to the beneficiary (exporter, non-resident organization).Eximgarant of Belarus offers an insurance product designed to protect the property interests of the Development Bank of the Republic of Belarus, which provides post-financing for a letter of credit issued by a foreign issuing bank, against the risk of non-performance by the latter of its obligations under the letter of credit, issued for the payment of goods (works, services) exported from the Republic of Belarus – insurance for the post-financing of letters of credit opened by foreign banks.

Post-financing of the letter of credit will provide foreign buyers of Belarusian goods with access to financing for payments under the export contract using a letter of credit.

The Development Bank of the Republic of Belarus provides post-financing for letters of credit opened by foreign banks for financing payments (including advance payments) by non-resident organizations for:

- goods included in the list and other goods (works, services) sold (being sold) by residents of the Republic of Belarus;

- goods included in the list and other goods (works, services) sold (being sold) by organizations that are not residents of the Republic of Belarus.

Post-financing is provided up to 100% of the export contract value.

The insurance period corresponds to the term of the issuing bank’s fulfillment of its obligations.

A mandatory condition of the insurance is the establishment of a waiting period of no more than 30 calendar days. The Insured’s own participation in covering potential losses (non-deductible excess) is not established.

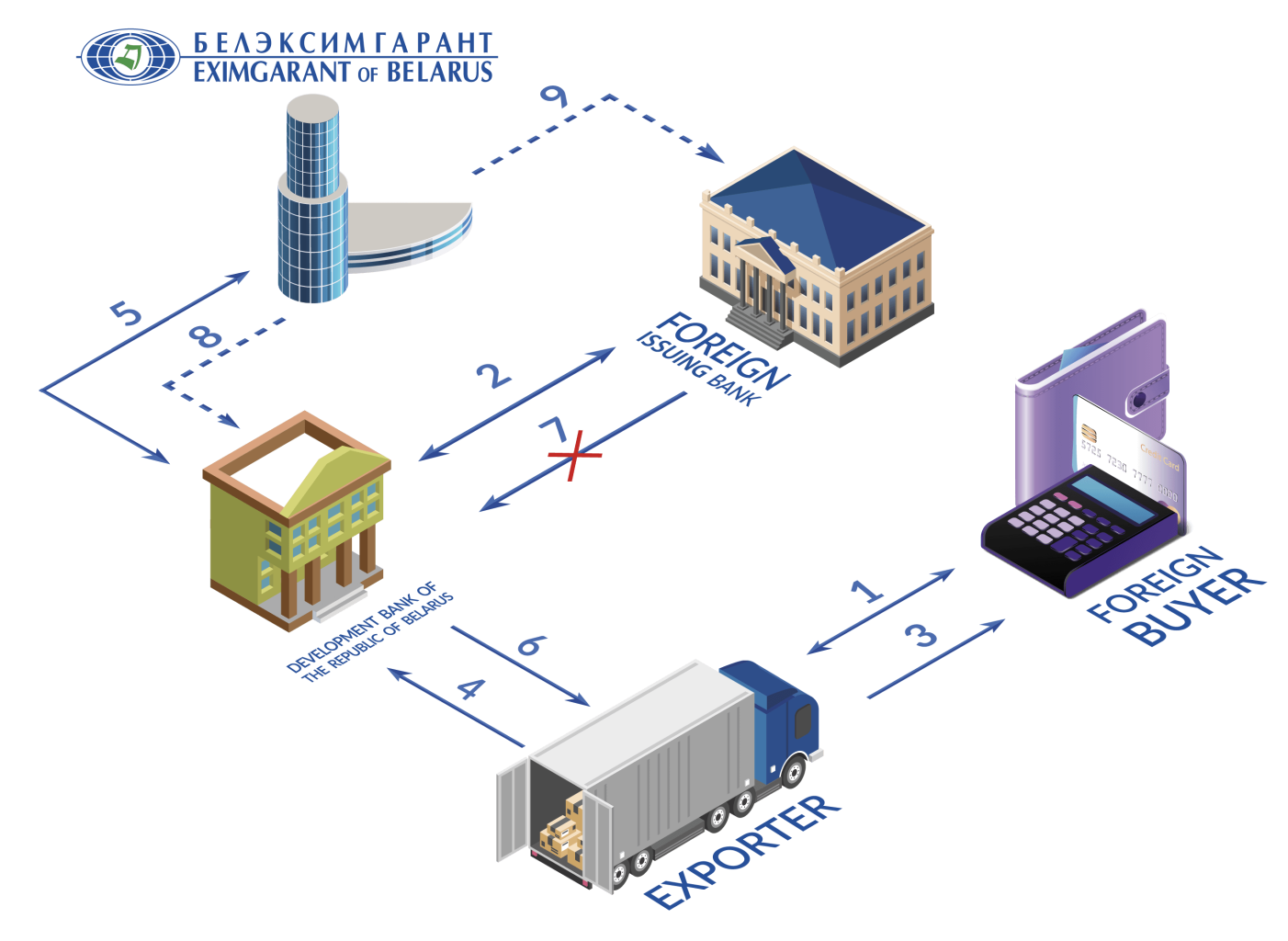

Procedure for collaboration:

1. Execution of an export contract with a letter of credit payment method;

2. Execution of an interbank loan agreement

3. Supply of products.

4. Transfer of documents for the shipped goods

5. Conclusion of an insurance contract.

6. Fulfillment of the confirming bank’s obligations under the letter of credit;

7. Non-repayment of the loan according to the terms specified in the loan agreement

8. Payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

9. Filing a claim against the issuing bank.

The list of documents required for the conclusion of an insurance contract:

- Application for conclusion of an insurance contract;

- The Insured’s legal registration documents;

- The issuing bank’s legal and financial documents;

- The export contract, the text of the letter of credit, and other documents containing the essential terms of the post-financing of the letter of credit.

Procedure for Notification upon the Occurrence of an Event Which, Under the Terms of Insurance, Could Be Deemed an Insured Accident:

To receive insurance compensation, the Insured is obliged to submit a claim to the Insurer regarding the insured accident within 3 business days from the date of occurrence of an event, which under the terms of insurance, could be deemed an insured accident, enclosing the following documents:

- Original of the insurance contract (insurance policy);

- Documents confirming the occurrence of the insured accident and the amount of losses;

- Documents confirming measures taken to prevent and/or mitigate potential losses;

- A written explanation from the issuing bank regarding the reasons for non-performance of its obligations;

- Court documents confirming the initiation of bankruptcy proceedings against the issuing bank, and a copy of the court decision in case of the issuing bank’s bankruptcy;

- Any other documents as requested by the Insurer.

For inquiries regarding this type of insurance coverage, please contact the Export Risk Insurance Department by phone/fax in Minsk at +375 (17) 371-00-65 or to any of the Eximgarant of Belarus offices.