- financing leasing companies-residents of the Republic of Belarus for purchasing goods produced by the residents of the Republic of Belarus included into the list approved by the Council of Ministers of the Republic of Belarus (hereinafter — goods included into the list) for further leasing out or selling to non-resident entities, except foreign banks;

- financing non-resident companies except foreign banks for payment for goods from the list or works, services realized by residents or for preliminary payment for goods from the list, or works, services produced and (or) realized by residents of the Republic of Belarus;

- financing non-resident companies except foreign banks for payment for goods from the list sold by non-resident entities and purchased by the latter from residents of the Republic of Belarus under export contracts not covered by export loans granted within the frames of this Decree;

- financing non-resident banks with a view of their subsequent financing of customers for payment for goods from the list or works, services realized by residents or for preliminary payment for goods from the list, or works, services produced and (or) realized by residents of the Republic of Belarus;

- financing non-resident banks with a view of their subsequent financing of customers for payment for goods from the list or works, services realized by non-resident companies or for preliminary payment for goods from the list, or works, services produced and (or) realized by residents of the Republic of Belarus;

Eximgarant of Belarus has introduced a special insurance product for banks — insurance against the risk of non-repayment of bank credit granted to a domestic exporter for the production of goods to be exported (the performance of works, the provision of services).

The insurance covers losses resulting from the borrower’s default on obligations under the credit contract with regard to the repayment of credit (the principal amount of liabilities) within the time as provided in the credit contract due to the borrower’s vulnerable economic standing or insolvency. Export credit for the production of the goods to be exported is available in euros and in US dollars at commercial interest reference rates (CIRRs), in Russian roubles — at the refinancing interest rate of the Central Bank of the RF, losses suffered by banks being compensated from the republican budget. By entering into an insurance contract you get an extra collateral for the whole principal amount of liabilities excluding franchise, so you don’t have to go through a long process of collecting debts.

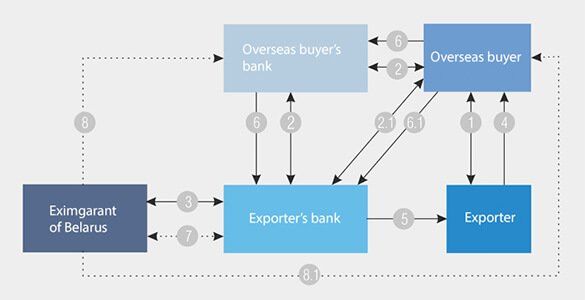

The procedure of interaction:

- export contract, previously agreed upon with Eximgarant of Belarus;

- interbank credit contract, credit contract concluded between the overseas bank and the overseas buyer;

- credit contract concluded between the domestic bank and the overseas buyer;

- insurance contract;

- shipment of products;

- transfer of funds to the exporter’s account;

- repayment of the interbank credit;

- repayment of the credit by the overseas buyer.

- payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

- raising claims against the overseas buyer’s bank;

- Raising claims against the overseas buyer.

The list of documents required for the conclusion of an insurance contract:

- application for the conclusion of an insurance contract;

- the Charter, constituent documents, the certificate of registry, the card containing specimen signatures and imprint stamp — in case it is the first contract concluded with this insurant;

- the borrower’s registration documents;

- credit contract with all the relevant documents attached, including the following:

- the borrower’s financial documents and statements of accounts as of the last reporting date, other evidence of the borrower’s credit worthiness;

- documents securing the repayment of credit: pledge agreements or guarantees, if any;

- treaties, contracts and other documents related to the deals for which the credit is to be granted;

- the insurer has the right to request from the insurant other documents essential for the evaluation of the degree of risk and for making a decision on the conclusion of an insurance contract.